Revenues for the quarter increased 34 percent to $187.7 million, driven by record trading volume and higher average exchange fee rates. Operating margin for the quarter, excluding merger-related expenses, rose nearly 15 percentage points to 54.6 percent, reflecting the effectiveness of the company’s operating model and its disciplined expense management.

Included in the first-quarter 2007 results are $13.0 million in merger-related expenses. These expenses are non-deductible for tax purposes and consist primarily of legal and advisory fees incurred in connection with the CBOT’s merger agreement with Chicago Mercantile Exchange Holdings Inc. (CME) and the previously-announced, unsolicited proposal from IntercontinentalExchange, Inc. (ICE).

“The positive momentum we built last year is carrying through into 2007, as we experience higher trading volume and continue to effectively manage expenses,” said CBOT President and CEO Bernard W. Dan. “I believe that the CBOT is better positioned than ever to provide market participants around the world with unique products, innovative risk management tools and deep, liquid markets.”

Dan continued, “This is a dynamic time for the CBOT and our industry, which is undergoing consolidation and intense global competition. We remain focused on driving growth, managing our day-to-day business and serving the diverse needs of our customers.”

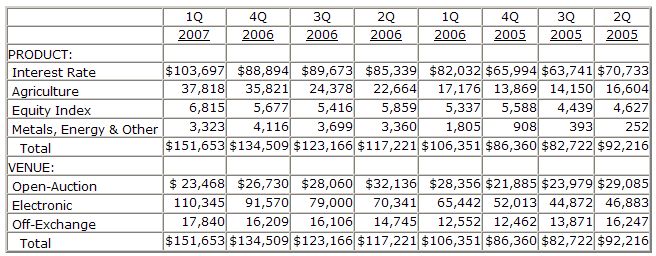

Revenue growth for the quarter was primarily driven by higher exchange and clearing fees, which increased $45.3 million, or 43 percent. This growth was a result of a 24 percent increase in trading volume and a 15 percent increase in the average rate per contract in the first quarter of 2007 compared with 2006.

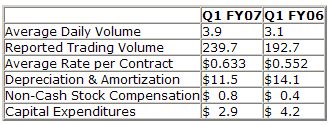

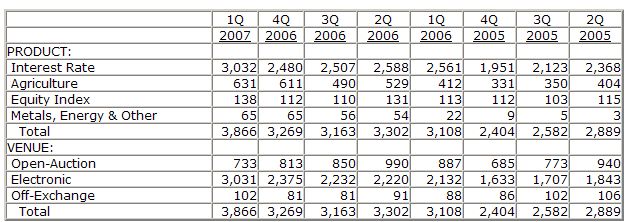

CBOT achieved record trading volume for the quarter with 239.7 million contracts traded, reporting volume increases across each of CBOT’s major product categories. Average daily volume (ADV) for the quarter was 3.9 million contracts, up 24 percent from the same period last year. Electronic trading volume increased 42 percent, boosting the percentage of trades executed on the CBOT’s electronic trading platform to 78 percent of total exchange ADV in 2007’s first quarter, up from 69 percent in the first quarter of 2006 and 73 percent in the fourth quarter of 2006. The higher level of electronic trading, in part, reflects the favorable reception by market participants to the electronic trading of Agricultural futures during daytime hours.

The average rate per contract was $0.633 for the quarter compared with $0.552 in the first quarter of 2006. The rate increase primarily resulted from changes in trading fees implemented in 2006, as part of the company’s strategy to further segment its pricing structure. The average rate per contract also benefited from increased electronic trading of Agricultural contracts following the August 1, 2006, introduction of electronic trading of Agricultural futures during daytime trading hours. The average rate per contract represents total exchange and clearing fee revenue divided by total reported trading volume.

Total operating expenses for the first quarter were $98.2 million, up 16 percent over the prior year’s first quarter. Excluding merger-related expenses of $13.0 million for the quarter, operating expenses were relatively flat compared with the prior year period. Volume-based expenses of $23.9 million rose 21 percent, in line with the growth in trading volume. Baseline and other costs, or non-volume based expenses, were $74.3 million this quarter compared with $64.7 million in the first quarter of 2006, a 15 percent increase. Excluding first quarter 2007 merger-related expenses, non-volume based expenses were down about 5 percent from last year’s first quarter.

Disciplined expense management was a key factor in delivering higher operating margins in the first quarter. The operating margin for the quarter increased to 47.7 percent from 39.7 percent in the same period last year. Excluding merger-related expenses, the operating margin for the quarter was 54.6 percent.

Other Financial Metrics

(in millions, except rate per contract)

CBOT First Quarter 2007 Operational Highlights

* Launched a new stock index futures contract based on the Dow Jones U.S. Real Estate IndexSM (DJUSRE), designed to help market participants capitalize on changes in the real estate sector of the stock market and better manage commercial real estate exposure.

* Expanded the CBOT Swap complex with a 30-year Interest Rate Swap futures contract, providing the swap market with a tradable reference point at the long end of the swap curve.

* Announced plans to launch mini-sized Ag futures contracts on CBOT’s electronic trading platform on May 14, 2007. The CBOT mini-sized Corn, Soybeans and Wheat contracts will trade electronically during overnight hours, while continuing to trade by open auction during daytime hours.

AVERAGE DAILY VOLUME (Round Turns, in thousands)

TRANSACTION FEES (in thousands)